Q2 in Review: USPTO Loosens Fintiv Limits as UPC Hits Two-Year Mark

July 15, 2025

NPE litigation was up by 30% in the first half of 2025, as an increase of 15% in the second quarter built upon a particularly active Q1 for such plaintiffs.

Meanwhile, Acting USPTO Director Coke Morgan Stewart has continued to roll back restrictions on discretionary denials at the Patent Trial and Appeal Board (PTAB), causing a drop in America Invents Act (AIA) review institution rates in Q2. The availability of AIA reviews could soon be even further constrained by a hotly debated decision calling for the denial of challenges against patents that have been longer in force due to “settled expectations”—and by another ruling that could even limit reviews of newer patents.

The second quarter further marked the two-year anniversary of Europe’s Unified Patent Court (UPC), which has come to play a key role in multi-venue patent campaigns—as recent decisions have bolstered the court’s already-sweeping jurisdiction with respect to infringement and damages.

Q2 saw notable activity in the standard essential patent (SEP) space as well, including a long-awaited UK appellate judgment on fair, reasonable, and nondiscriminatory (FRAND) rate-setting and Japan’s first-ever SEP injunction. China has additionally continued its antitrust scrutiny of patent pools, releasing new guidance on pools in the second quarter.

RPX also closely tracked developments in US IP policy during a particularly busy Q2, which saw the reintroduction of legislation aimed at reforming patent eligibility and AIA reviews and a retirement announcement by those bills’ primary co-sponsor, plus an attempt at changing the tax treatment of third-party litigation funding. Moreover, President Donald Trump’s nominee for the next USPTO director has moved closer to Senate confirmation, as the agency grapples with a diminishing headcount, an all-time-high patent application backlog, and pressure from a Congressional watchdog report to prioritize quality over quantity.

Finally, RPX continues to monitor new litigation brought by funded patent plaintiffs, as well as patent assignments to entities formed, and ostensibly managed, by third-party litigation funders. The second quarter saw new activity in both respects.

RPX members also have exclusive access to an on-demand RPX Community webinar covering highlights from this post; CLE credit may be available.

Litigation Update: NPE Filings Swing Upward in 1H 2025, Boosted by Surge in Q1

PTAB Update: Acting Director’s Expansion of Fintiv Prompts Controversy

UPC Update: Two Years in, Court Plays Key Role in Multi-Jurisdictional Disputes

FRAND Update: Courts Issue Significant SEP Rulings in UK and Japan; China Continues Pool Scrutiny

Patent Market Update: New Funded NPE Litigation and Notable Patent Transactions

Litigation Update: NPE Filings Swing Upward in 1H 2025, Boosted by Surge in Q1

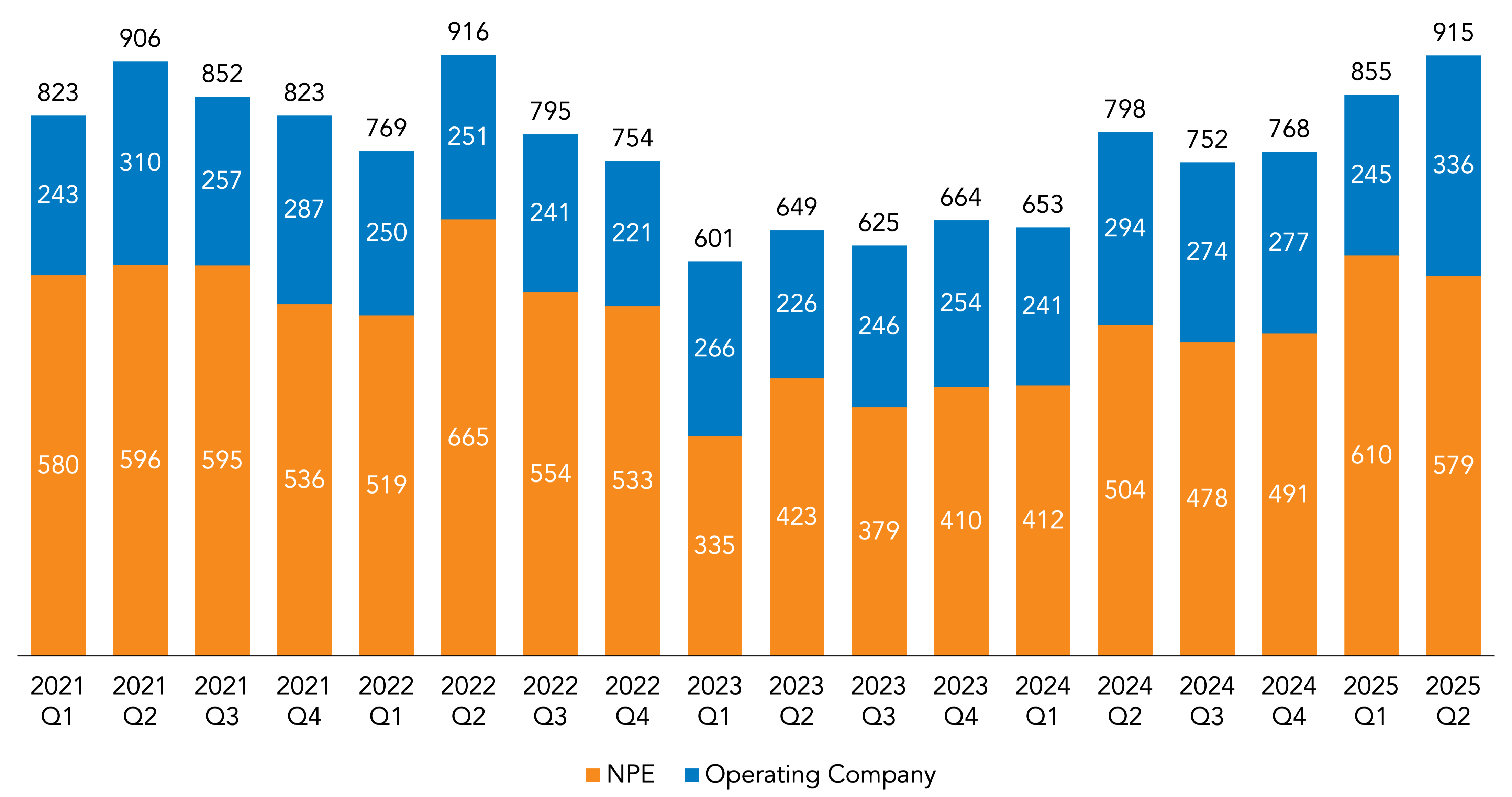

NPEs added 1,189 defendants to patent litigation campaigns in the first half of 2025, a 30% increase from that same period last year (when NPEs added 916 defendants)—bolstered in part by an especially large upswing in Q1, which saw the most NPE litigation in any first quarter since Q1 2015 (for an increase of 48%).

Meanwhile, in the second quarter, NPEs added 579 defendants, a 15% increase compared to Q2 2024 (504 defendants). Second-quarter NPE filings were down by 5% compared to Q1 2025 but exceeded the trailing Q2 average for 2022-2024 by 9%.

| Defendants Added | Change Compared to: | ||||

| Q2 2025 | Q2 2024 | Q2 2022-2024 Average | Q1 2025 | ||

| NPE | 579 | 15% | 9% | -5% | |

| Operating Company | 336 | 14% | 31% | 37% | |

| Total | 915 | 15% | 16% | 7% | |

Operating company plaintiffs added 581 defendants in the first half of the year, an increase of 9% compared to 1H 2024.

In the second quarter, operating companies added 336 defendants, or 14% more than in Q2 2024 (when they added 294 defendants). Operating company filings in Q2 2025 exceeded the first quarter by 37% and beat the Q2 2022-2024 trailing average by 31%.

Overall, patent plaintiffs added 1,770 defendants in 1H 2025, for an increase of 22% from the first half of last year. Plaintiffs added 915 defendants in Q2 2025, going up by 15% compared to the second quarter of 2024, by 7% from Q1 2025, and by 16% compared to the trailing average.

Additionally, the operating company data above leave out another distinct category of litigation filed by a small group of design and utility patent owners targeting copycats and counterfeiters selling products online. RPX excludes such “e-seller” cases from analyses of district court litigation because they tend to follow a different dynamic compared to what one might consider the usual patent suit. These e-seller cases sometimes name hundreds of defendant entities, many of which may be merely online storefronts or aliases for the same ultimate parent. Also, plaintiffs primarily seek injunctive relief instead of damages, and their cases often end with the e-seller defendant’s failure to answer, followed by a default judgment.

This category of litigation is shown in grey below to illustrate its magnitude. As shown by the rightmost bar, e-seller litigation in Q2 2025 accounted for 2,238 defendants added, or 71% of all litigation during the quarter—though this number remains subject to the caveat about defendants potentially having multiple online storefronts noted above.

Apart from the following graph, the other analyses in this report exclude pure design patent and e-seller litigation.

Venue Update: East Texas Tops the Charts Once Again as Government Pushes Judge Gilstrap on NPE Injunctions

The Eastern District of Texas was the top patent district for overall litigation (i.e., with no filter for plaintiff type) and NPE litigation in Q2 2025, also taking the number-three spot for operating company litigation. In second for both overall and NPE litigation was the Western District of Texas. The District of Delaware held third place in both categories, though it was the most popular venue for operating company litigation.

Shortly before the end of the second quarter, the Eastern District of Texas became the battleground for a new fight over the availability of injunctive relief in NPE suits.

Historically, NPEs seeking injunctive relief in US district courts have faced an uphill battle over much of the past two decades. Under the Supreme Court’s 2006 decision in eBay v. MercExchange, courts must apply a four-factor equitable test when deciding requests for permanent injunctions—including one factor requiring a party to show that it would suffer “irreparable harm” without an injunction. NPEs have typically struggled to clear that threshold, in part because they typically cannot show competitive harm from infringement beyond what damages, as a remedy at law, could compensate.

However, the US government, via the Department of Justice’s Antitrust Division and the USPTO, pushed the Eastern District of Texas to revisit that standard in a June 24 statement of interest filed in a case from Radian Memory Systems LLC (RMS), a plaintiff tied to Fortress Investment Group LLC, over which District Judge Rodney Gilstrap presides. The government argued that courts should consider the difficulty of valuing patents and calculating damages for their infringement when weighing irreparable harm, asserting that there should be no categorical rule barring NPEs from injunctive relief on that basis.

That said, on July 11, RMS withdrew its request for a preliminary injunction, which had served as the basis for the government’s statement of interest—indicating that the government will need to find another case in which to pursue this issue.

More on the government’s brief—which has already begun to have a ripple effect in other litigation—can be found here.

Meanwhile, Judge Gilstrap, who served as the district’s chief judge until March 1, was once again the nation’s top district judge by a large margin—overseeing 19% of all Q2 patent litigation:

Western District of Texas Judge Alan D. Albright, once the nation’s top patent judge, held a distant fifth place in Q2. Judge Albright, a former patent litigator, had previously amassed the bulk of the nation’s patent cases after openly and successfully seeking to attract such litigation to his courtroom. Plaintiffs could seek him out directly due to divisional filing rules that let plaintiffs file directly in a certain division, thus guaranteeing they would get Judge Albright, as Waco’s only district judge. However, this all changed due to a July 2022 case assignment order designed to reduce the concentration of patent cases before Judge Albright, by directing all Waco patent cases to be randomly assigned among a larger group of judges, including Judge Albright. His patent caseload has slimmed dramatically as a result.

Judge Albright is now poised to move on from Waco altogether: In early January 2025, he confirmed that he would be moving to the Austin Division to fill one of that division’s two vacancies, and that he had received signoff from the judges of the Western District and from the Fifth Circuit Judicial Council, with just the final signature of Chief Judge Alia Moses remaining. Judge Albright has stated that he would stay in Waco until his replacement is confirmed by the US Senate; while no one has yet been nominated, Judge Albright has endorsed Magistrate Judge Derek Gilliland for the role. Though Judge Albright nominally still remains in Waco, the bulk of the new patent cases assigned to him in Q2 were from Austin—and none were from Waco.

The remaining handful of Judge Albright’s Q2 cases were assigned to him with his consent by Midland-Odessa District Judge David Counts. Judge Counts, also a former patent litigator, had not previously attracted many patent cases but saw a marked rise in such litigation after he adopted a patent standing order based in large part on Judge Albright’s in the wake of the July 2022 case assignment order.

Notably, Judge Counts is the only judge in Midland-Odessa, where no special patent case assignment rules apply—allowing plaintiffs to seek out his courtroom in the same manner as they did Judge Albright’s.

They have clearly done so, with Judge Counts now overseeing the second-most new litigation in the nation this past quarter—including the majority of litigation filed in West Texas in Q2.

Market Sector Update: Monetization Firms and Veteran Assertion Professionals Target E-Commerce and Software Sector in Q2

The top market sector for NPE litigation in Q2 2025 was E-Commerce and Software, accounting for 44% of the defendants added to patent litigation campaigns during the quarter. Networking saw the second highest amount of NPE litigation in Q2, followed by Financial Services, Automotive, and Consumer Electronics and PCs.

The plaintiffs hitting this space in Q2 included several NPEs linked to prominent patent monetization firms. For instance, Dominion Harbor Enterprises, LLC plaintiff Arlington Technologies, LLC added a new complaint in late May to its ongoing communications campaign, targeting web conferencing products with various features related to recording, playback, collaboration, and meeting management. Also hitting communications platforms—here, those that support features for notifying users of missed calls, in a case filed in late May—was MISSED CALL, LLC, a plaintiff controlled by Dynamic IP Deals LLC (d/b/a DynaIP) via another entity, Pueblo Nuevo LLC, in a campaign beset by drama over disclosures in Delaware. Another DynaIP plaintiff, Random Chat LLC, alleged infringement through websites with customer support chat services in a set of complaints brought in early June. Additionally, Georgia-based monetization firm IPInvestments Group LLC, through associated plaintiff DigiMedia Tech, LLC, expanded its ongoing campaign with an early May complaint targeting cloud storage websites and apps with features for deleting, moving, and uploading images.

Also taking aim at E-Commerce and Software in Q2 were various plaintiffs associated with notable individuals active in the patent assertion space. One patent monetization professional who appears to be linked to a growing number of NPE plaintiffs was particularly busy, hitting this sector through five distinct plaintiffs in Q2: Authentixx LLC, which has disclosed that its litigation counsel, a third-party funder, and the asserted patents’ former owner hold a financial interest in its litigation, brought a wave of complaints in late June over website authentication technology; Media Key LLC, which filed additional litigation focused on devices with features for automatically downloading and installing mobile app updates in mid-May; Cascade Systems LLC, which launched a campaign over online products or services with features allowing customers to license or purchase media content that is then transferred via a content delivery network (CDN) in early May; Hyperquery LLC, which in mid-April filed a new wave of complaints targeting digital marketplaces (e.g., app stores, software stores, and websites), targeting features for allowing users to search for and download mobile apps and/or software products; and OrderMagic LLC, which in early April filed a cluster of complaints against various restaurants over the provision of mobile apps and/or websites for mobile ordering. Another plaintiff tagging the E-Commerce and Software space—in particular, through a late-May complaint over various communications products, with allegations highlighting features related to automatic callback, diagnostics tools, and video meetings—was Diorite Technology, LLC, an entity controlled by two individuals linked to a growing group of other plaintiffs with similarly stone-themed names through an entity under their control, Bedrock IP Co., Ltd.

PTAB Update: Acting Director’s Expansion of Fintiv Prompts Controversy

The Patent Trial and Appeal Board (PTAB) saw 366 petitions for America Invents Act (AIA) review in the second quarter of 2025, including 351 petitions for inter partes review (IPR) and 15 petitions for post-grant review (PGR). Filings were up by 11% compared to Q2 2024, which saw 329 petitions filed; and were unchanged from Q1 2025, during which 366 petitions were also filed.

The PTAB instituted trial for 51% of the AIA review petitions addressed in Q2, down substantially from that same quarter last year (during which the institution rate was 75%) and from Q1 2025 (67%).

– USPTO Changes Remove Fintiv Restrictions

The primary cause of that decline has been a series of changes by Acting USPTO Director Coke Morgan Stewart that have steadily expanded the use of discretionary denials at the PTAB.

In February, Stewart withdrew guidance from her predecessor, Kathi Vidal, that limited such denials based on parallel litigation under the NHK-Fintiv rule. That guidance, issued by Vidal in June 2022, limited the application of NHK-Fintiv by creating several safe harbors allowing petitioners to avoid discretionary denials in certain circumstances: In part, it exempted petitions that present “compelling, meritorious challenges”, and established that the NHK-Fintiv factors apply only to district court litigation and not investigations before the ITC, since the latter lacks the power to issue binding invalidity rulings. The guidance also limited the Board’s ability to deny institution based on the proximity of the district court’s scheduled trial date to the PTAB’s final written decision deadline. Additionally, the guidance provided that discretionary denial would not occur where petitioners agree not to assert invalidity grounds that they raised or reasonably could have raised at the PTAB in a parallel district court case—formalizing a practice established in the PTAB’s December 2020 precedential decision in Sotera Wireless v. Masimo, now known as a “Sotera stipulation”.

The following month, on March 24, PTAB Chief Administrative Patent Judge (APJ) Scott Boalick clarified the withdrawal in a memorandum (the “Boalick memorandum”) that explicitly repudiated the key points from the rescinded 2022 guidance: It explicitly established that the NHK-Fintiv factors will also apply for parallel ITC actions; explained that Sotera stipulations may be “highly relevant” but not dispositive on their own; loosened the “time to trial” factor by allowing any evidence bearing on district court trial dates or ITC final determination target dates; and underscored that “compelling merits” alone cannot be “dispositive” in the discretionary denial inquiry, providing instead that the merits are just one of the factors to be considered in a “balanced assessment”. The Boalick memorandum also provided that the withdrawal applied to all PTAB proceedings in which the Board had not yet issued an institution decision or in which a request for rehearing or director review was filed and remained pending.

Two days later, on March 26, Stewart issued a memorandum that established a new two-stage process for AIA review institution: Now, the USPTO director first decides whether to issue a discretionary denial, and only if she determines such denial is inappropriate will she then refer the case to a standard three-member PTAB panel to make an institution decision that addresses the merits. The memorandum provides a broader list of relevant considerations for the director’s discretionary denial assessment that are drawn from certain precedent, including Fintiv; General Plastics, which lays out factors under which multiple petitions from the same petitioner can be discretionarily denied; and Advanced Bionics, which covers discretionary denials where the USPTO has previously considered the asserted prior art or arguments. The memo additionally notes that the director will also consider the PTAB’s workload, including its ability to hit the statutory deadlines for AIA review trials, in making that determination—a change that is of particular significance given the sweeping staffing changes being enacted across the federal government by the administration of President Donald Trump.

– Retroactive Application Prompts Pushback

The USPTO now faces Federal Circuit pushback from two PTAB petitioners, SAP and Motorola Solutions, that had filed IPRs prior to the withdrawal of the Vidal guidance, in which they agreed to broad Sotera stipulations in order to avoid discretionary denial as provided in the guidance.

In SAP’s case, the withdrawal of that guidance, and the Boalick memorandum’s extension of that withdrawal to pending IPRs, both took place after SAP filed its petitions but before the PTAB had issued its institution decisions. As a result, the Board discretionarily denied SAP’s petitions, finding that its Sotera stipulation would not sufficiently avoid duplicative litigation because it would not bar the company from asserting a district court invalidity defense based on the public use or sale of the same prior art (i.e., system prior art), a ground not available in the IPR. While the Motorola IPRs had already been instituted by the time that Stewart withdrew the guidance, the Acting Director reviewed those decisions at the patent owner’s request—similarly finding that the PTAB had given Motorola’s Sotera stipulation too much weight because Motorola also asserted district court invalidity arguments based on system prior art that the stipulation was unlikely to moot.

Both parties then turned to the Federal Circuit—but since direct appeals of matters related to institution are barred under the Supreme Court’s Cuozzo Speed Technologies v. Lee decision, they did so through petitions for writ of mandamus, which Cuozzo—as interpreted by the Federal Circuit in Mylan Laboratories v. Janssen Pharmaceutica—allows for “colorable constitutional claim[s]” related to discretionary denials.

SAP and Motorola both assert that by withdrawing the guidance without explanation and without considering the reliance interests of petitioners banking on Sotera stipulations, and then by making the withdrawal apply retroactively to pending IPR petitions, the USPTO violated the Due Process Clause of the Fifth Amendment to the US Constitution. SAP additionally argues that the withdrawal effectively rewrites the estoppel statute by requiring that petitioners offer a much broader stipulation than the statute requires to have any hope of avoiding Fintiv, thus violating the separation of powers. Motorola further contends that both the withdrawal of the Vidal guidance and the “retroactive” application of that withdrawal violate the Administrative Procedure Act (APA), asserting that when Vidal adopted a “binding” rule through the June 2022 guidance, it could not be later rescinded by Stewart without notice-and-comment rulemaking.

A host of industry associations have also sought to file amicus briefs in support of the petitioners in both cases. More on those filings and the two mandamus petitions is available here.

– Decision Allowing Denials Based on “Settled Expectations” Draws Controversy

Stewart has also continued to issue decisions that could further expand the use of discretionary denials since withdrawing the Vidal guidance. One that has attracted some of the most heated criticism has been Stewart’s June 6 decision in iRhythm Technologies v. Welch Allyn.

In the March 26 memorandum that created the bifurcated institution process, Stewart set forth a series of factors the director may consider in deciding whether to discretionarily deny institution—including “[s]ettled expectations of the parties, such as the length of time the claims have been in force”. The iRhythm decision makes it clear that Stewart may deny institution solely on the basis of such “settled expectations”: In that case, the acting director noted that the petitioner had cited the then-pending application that would issue as the challenged patent in a 2013 Information Disclosure Statement (IDS) filed in its own patent application, finding that that “awareness of Patent Owner’s applications and failure to seek early review of the patents favors denial and outweighs the above-discussed considerations”.

Stewart has since held that while there is no “bright-line rule” here, “the longer the patent has been in force, the more settled expectations should be”—and that no “actual notice” is required to create settled expectations, since patents and published applications are publicly available. The acting director has also clarified that there may be certain “persuasive reasons” why the PTAB should still review a patent “several years after” its issue date, including where there has been a “significant change in law” that bears on patentability or where the patent has not been “been commercialized, asserted, marked, licensed, or otherwise applied in a petitioner’s particular technology space, if at all”.

The iRhythm decision has since “unsettled the IP community”, as remarked by petitioner iRhythm Technologies in its July 3 request for director review. Critics include former Director Vidal, who has warned that the ruling could have “far-reaching and damaging consequences”—arguing that it could deter applicants from seeking out prior art during prosecution, and that it is “unreasonable” to expect innovators to track patent applications in order to predict future infringement liability for products they have not yet created. Stakeholders have additionally sparred over whether patent owners actually have “settled expectations” in this context: Vidal has argued that they do not, given that validity challenges have always been possible in some form, pushing back against assertions that only early review should be allowed. Stanford Law School Professor Mark Lemley has also echoed Vidal’s criticism that early challenges may not be practical where a company does not yet make potentially infringing products—adding that late challenges often result from a patent nearing the end of its life that is sold to an NPE for assertion.

Stewart has since issued a ruling that could even limit reviews of more recently issued patents: On July 10, the acting director denied a set of petitions challenging patents issued in 2021 and 2024. While Stewart ruled that “[o]rdinarily this might favor referral to the Board”, she held that denial was nonetheless warranted because the petitioner had “not offered a stipulation to address concerns of duplicative efforts and potentially conflicting decisions in view of a significantly earlier trial date in a co-pending case that is unlikely to be stayed”. Further details can be found here.

– Reexams Rising as Discretionary Denial Changes Constrain IPRs

As petitioners face the likelihood that IPR availability will be further constrained, they appear to have made a familiar shift back toward ex parte reexaminations—which, while slower than IPRs, are not subject to discretionary denials to the same extent.

The popularity of reexams has tended to climb in response to policy shifts bolstering discretionary denials: In 2020, the year that the Fintiv decision was designed as precedential, the number of requests for ex parte reexam increased by 21%, and then by 53% in 2021. While they held steady at about 330 requests per year in 2022 (the year Vidal issued the just-overturned guidance limiting NHK-Fintiv) and 2023, they surged by 27% in 2024 (following a decision by Vidal, in CommScope v. Dali Wireless, that limited the “compelling merits” exception then in effect).

After a relatively flat first quarter, reexams swung back upward by 32% in Q2 compared to the same quarter last year—coinciding with most of the aforementioned rollbacks to Vidal-era Fintiv restrictions. The second quarter saw the second-highest number of reexam requests of any quarter in the past six years, falling just short of Q3 2024. Reexam filings in the first half of the year were also 13% higher compared to 1H 2024.

Additionally, data indicate that the share of patents with reexam requests that have also been litigated in district court was 68% in 1H 2025, up from 54% last year. Data also show that defendants have requested IPRs for a decreasing share of those same patents, from a peak of 36% in 2021 to 20% in 2024 overall and 21% in the first half of 2025.

UPC Update: Two Years in, Court Plays Key Role in Multi-Jurisdictional Disputes

The EU’s Unified Patent Court (UPC) has upended the litigation landscape in Europe since its launch just over two years ago. In 2025, the court has played an increasingly significant role in multi-venue patent disputes and NPE campaigns, while recent decisions have further expanded the court’s reach.

– UPC Filings at the Two-Year Mark

On June 5, 2025, the UPC released its latest caseload data, indicating that the court has received 883 cases from its June 1, 2023 launch through May 31, 2025, including 320 infringement actions.

Plaintiffs have heavily favored the UPC’s four German local divisions since the court’s inception, and those divisions have seen by far the most infringement filings as of the court’s second anniversary—accounting for 76% of those cases in total, the majority filed in the Munich Local Division (Munich LD). This preference may reflect plaintiffs’ desire to have issues decided in a similar manner to Germany’s national caselaw, and indeed that has generally been the case for issues ranging from claim construction to validity and even (for the most part) for the rules governing standard essential patent (SEP) licensing.

The UPC’s continued popularity in part reflects the speed and scope of available relief: Cases typically reach final merits decisions in less than 14 months on average, according to the court’s first-ever annual report (which issued in February); while a finding of infringement results in a permanent injunction that can cover up to all 18 member states. The UPC has also shown a willingness to grant preliminary injunctions, doing so quickly (within just a few months on average) and in some instances on an ex parte basis (i.e., without notice to the accused infringer).

The prospect of such sweeping injunctions can provide significant leverage, and as a result, UPC litigation has been widely viewed as key driver of settlements in multijurisdictional campaigns (see, e.g., here). Settlements reportedly increased significantly starting in Q4 2024, when the UPC’s first cases began reaching judgments on the merits, and continued into the new year. Notable examples include litigation between Huawei and NETGEAR, which settled in December after the Munich LD barred NETGEAR from selling Wi-Fi 6 routers in six countries, in one of the UPC’s first SEP injunctions; and litigation between Valeo and Magna over automotive gearbox motor generators used primarily in BMWs, which settled in January after the Düsseldorf Local Division (Düsseldorf LD) issued a pair of preliminary injunctions in October—albeit, with a carveout for current BMW models. Two other settlements also came in SEP campaigns with UPC litigation, albeit driven by activity outside the UPC: one in early April in the cellular dispute between Ericson and Lenovo, following notable appellate rulings in the UK; and the video codec dispute between Nokia and Amazon, following a series of developments related to injunctions in Germany and the US. A variety of settlements also ended pharma litigation at the UPC throughout the first half of the year, most recently litigation filed by Roche in multiple UPC local divisions, against multiple defendants, over insulin distribution technology.

The UPC also offers damages with a similarly sweeping reach, collectively covering a market approximately the same size as the US—making the court attractive to NPEs as well. Indeed, a variety of NPEs filed UPC litigation in the second quarter: InterDigital, Inc. brought two suits against Disney over video color mapping and peer-to-peer distribution patents on April 7; longtime German monetization firm Papst Licensing GmbH & Co., KG sued Intel over a processor security patent on April 16 (the first UPC action for both parties), subsequently bringing cases against robot vacuum makers Ecovacs and Roborock over an autonomous robot control patent on June 3; and Sun Patent Trust filed two complaints against Vivo over a wireless communications patent on April 23.

Additionally, Powermat Technologies, Ltd. brought a second SEP suit against Anker over Qi charging technology on May 6; Headwater Research LLC sued Apple on May 19 and Samsung over two patents both related to network capacity management on June 6, Innovative Sonic Limited filed a pair of complaints against Oppo and Xiaomi in late May over the same wireless communications patent on May 23; Wilus Institute of Standards & Technology, Inc. filed a SEP case against Asus over Wi-Fi 6 technology, also on May 23; Fortress Investment Group LLC plaintiff DivX, LLC sued Netflix over a video streaming patent on May 27; and Sol IP, LLC filed two cases against Chinese automaker BYD, also on May 27.

EyesMatch, Ltd. further sued Microsoft, apparently over Microsoft Teams, on June 2; and a Polish affiliate of Texas NPE Crystal Clear Codec, LLC sued Oppo over mobile device speech coding technology on June 5.

All of those Q2 NPE suits were filed in the German local divisions apart from those from Sol IP, which were filed in The Hague; and those from Sun Patent Trust, which were filed in Paris.

Caselaw Update: Appellate Decisions Extend UPC’s Reach

– Long-Arm Jurisdiction over Infringement of Non-EU Patents

One of the most significant decisions impacting the UPC this year came from the Court of Justice of the European Union (CJEU), which in late February issued a sweeping decision on long-arm jurisdiction in BSH Hausgeräte v. Electrolux that could significantly increase the UPC’s reach. While EU law already allowed courts in member states (and the UPC, by extension) to hear infringement claims over patents in other member states, a key exception—found in Article 24(4) of the Recast Brussels Regulation—was previously read to establish that the court hearing infringement had to stay the case when a validity challenge was filed in the patent’s state of issuance. BSH provided that a stay is no longer required, giving courts the leeway to do so if the validity challenge is reasonably likely to succeed. The CJEU also held that the UPC, and member states, may rule on the validity of patents in non-EU countries not subject to special rules similar to Article 24(4), though those validity decisions are merely inter partes (i.e., they only impact the parties to the case at hand).

The upshot of BSH is that national courts in EU countries, as well as the UPC, may now award damages and/or impose injunctions for the infringement of non-EU patents as long as the defendant is domiciled in the EU (for national court litigation) or in one of the 18 countries participating in the UPC (for UPC litigation).

The UPC has since applied BSH in principle to allow infringement claims in non-UPC EU countries, either by dismissing preliminary objections to that jurisdiction or granting motions to amend—allowing claims to proceed over the infringement of patents issued in the Czech Republic (an EU state that has signed but not ratified the UPC Agreement), Poland and Spain (EU states that have not signed the UPC Agreement), Switzerland (which is not in the EU but follows similar jurisdictional rules for cross-border enforcement under the Lugano Convention), and the UK (which is longer in the EU after Brexit, and has been denied admission into the Lugano Convention).

– Jurisdiction over Pre-UPC Damages and Damages During Opt-Out Period

Another set of notable, recent UPC decisions dealt with the extent of the court’s jurisdiction to award damages. In mid-January, the Court of Appeal—specifically, the second of the appellate court’s two panels—decided in Fives v. Reel that not only does the UPC have the power to hear a damages-only claim based on an infringement judgment from a national court, it may also award damages reaching back before the UPC’s start date—in this case, all the way back to 2016.

On June 2, the Court of Appeal’s first panel also held, in Esko-Graphics Imaging v. XSYS, that the UPC may award damages for pre-UPC infringement, citing Fives. The panel additionally addressed the impact of a patent owner’s decision to opt a patent out of the UPC’s jurisdiction and then withdraw that opt-out—holding that the UPC may then hear claims of infringement that arose during the time the patent was opted out. The reason, per the panel, is that “[t]he provisions on withdrawal do not provide for a partial or limited withdrawal”—so a patent is entirely out of the UPC’s exclusive competence or entirely in, without limits (apart from the parallel jurisdiction of national courts over the patent that applies during the UPC’s initial transitional period).

FRAND Update: Courts Issue Significant SEP Rulings in UK and Japan; China Continues Pool Scrutiny

– UK: Court of Appeal Doubles Down on Conventional Comparables-Based Valuation Approach

On May 1, the UK Court of Appeal issued its long-awaited judgment in a standard essential patent (SEP) case filed by three subsidiaries of PanOptis Holdings, LLC (collectively, “Optis”) against Apple. The appellate court overturned a May 2023 decision from High Court Justice Marcus Smith that had set a global fair, reasonable, and nondiscriminatory (FRAND) rate of $56.43M, ruling that he had erred by rejecting the parties’ expert evidence and rate-setting arguments in favor of a rate-setting approach not proposed by either party—one that took the average of the unpacked royalty rates from a larger group of comparable licenses without properly assessing their reliability. The Court of Appeal held instead that the proper methodology was a conventional comparables approach, using unpacked data for just the comparable licenses determined to be most reliable to derive a rate—based on which the court ultimately decided to set a $0.15 per device rate, the midpoint between the higher rate from an Optis license with Google and the relatively lower rates found in the four best comparables from Apple. Converted to a lump sum, the judgment totaled $502M plus interest.

Among other issues, the Court of Appeal’s decision also notably addressed the impact of its judgment on the US leg of Optis’s litigation with Apple—in particular, how to account for potential double recovery between the license rate from the UK judgment and the $300M in damages awarded by an Eastern District of Texas jury in August 2021, a point of some dispute between the parties. Here, the Court of Appeal decided against merely amending the UK judgment to account for the Texas judgment, dismissing that option as impractical due to the valuation methodology at issue in the UK litigation. Rather, the Court of Appeal instead held that the final amount of the Texas judgment should serve as a “floor”, and that to the extent the global FRAND rate determined by the UK court exceeded that amount, Apple would pay the balance to Optis.

That $300M US judgment has itself been overturned on appeal, however: On June 16, 2025, the Federal Circuit ruled that District Judge Rodney Gilstrap’s use of a general verdict form—asking whether “ANY” of the five tried patents were infringed, rather than asking about infringement for each patent separately—violated Apple’s Seventh Amendment right to a unanimous jury verdict, reversing and remanding for a new trial as a result.

With the questions of both infringement and damages now potentially headed for resolution by yet another US jury, that floor for the UK judgment could shift yet again—perhaps significantly.

– Japan: Court Issues Country’s First SEP Injunction

Another significant SEP development came in Japan, where the Tokyo District Court issued the country’s first-ever SEP injunction on June 23, in litigation filed by Pantech Corporation against Google. This was a particularly notable outcome given the highly restrictive standard that courts have previously applied in SEP disputes: In May 2014, the Grand Panel of the Intellectual Property High Court in Tokyo held in Apple v. Samsung that it would be an “abuse of right” (the Japanese equivalent to negotiating in bad faith) for a SEP holder to pursue an injunction against a willing licensee. While the Grand Panel held that an injunction may be sought against an unwilling licensee, it warned that “a finding of unwillingness must be made with great caution”. Stakeholders have viewed that decision as setting a “high threshold” for SEP injunctions—and no court had since revisited the underlying FRAND issues, including the FRAND obligation and abuse of rights doctrine, according to SEP Study Group Chairperson Toshifumi Futamata.

That changed in Pantech v. Google. In that case, the parties had reportedly agreed to a settlement after the Tokyo District Court determined infringement. However, when asked to present a settlement amount based on the total sales amount of infringing products—a FRAND rate-setting approach established by the 2014 Grand Panel decision—Google declined to do so, stating that doing so would be “excessively complex”. For that reason, and because Google had “delayed negotiations” (as characterized by MLex) and had not disclosed sales amounts or volumes, the court deemed the defendant unwilling.

Meanwhile, in a companion Pantech case against Asus, the court awarded royalties but declined to impose an injunction, noting that while there was a substantial gap between the parties’ proposed rates, “Japan lacks a well-established methodology for calculating FRAND royalties” (per Futamata’s summary). Thus, this was considered an insufficient basis to determine that Asus had failed to negotiate in good faith, the court concluding as a result that the defendant had been a willing licensee against which an injunction would be an abuse of rights.

– China: New Patent Pool Guidelines Reflect Continued SEP Antitrust Scrutiny

In China, the government has increasingly scrutinized SEP licensing practices for potential antitrust issues, with a particular focus on patent pools. This first ramped up last June, when the Anti-Monopoly Division of China’s State Administration for Market Regulation (SAMR) launched an unprecedented inquiry into the business model of pool administrator Avanci LLC over potential “monopoly risks” posed by its automotive pool. In November, SAMR then issued a final set of antitrust guidelines for SEP licensing that detailed circumstances where pools can potentially exert monopoly power and reduce competition, and encouraged pools to proactively work with antitrust authorities to address potential compliance issues.

The government has since further detailed its plans for taking a more active role in regulating patent pools, building on those prior initiatives: On May 7, the China National Intellectual Property Administration (CNIPA) published its 2025 Intellectual Property Nation Building Promotion Plan, which in part set a goal to both promote the creation of “patent pools in key areas” and to “strengthen the supervision of standard essential patents and patent pools in key areas such as information and communications, and carry out anti-monopoly supervision”.

Then, on May 13, a larger group of agencies—CNIPA, SAMR, the Chinese Academy of Science, the Ministry of Science and Technology, the Ministry of Industry and Information Technology, and the State-Owned Assets Supervision and Administration Commission of the State Council—released a set of guidelines for the “construction and operation of patent pools” (quoted here, and below, via an unofficial translation). The government has since explained that the guidelines are meant to address a “large gap in the level of development” of Chinese pools relative to “mainstream international” ones.

The new guidelines lay out four key principles patent pools must follow: they must follow a “market-oriented” business model that “conforms to the characteristics of the industry and the needs of enterprises”; they must protect the interests of licensors and licensees, strike a balance between “licensing rates and industrial profits”, and factor in the interests of entities throughout the innovation pipeline, from invention through implementation; they must allow all domestic and foreign patent licensors to join pools, participate in their operation, and “obtain due rights and interests”; and they must be non-discriminatory, offering “equal opportunities” for all patent users to obtain licenses under FRAND “rules”. Subsequent provisions detail in part how license fees should be “reasonable” based on certain criteria; and how pools should provide a “moderately transparent information disclosure mechanism”, wherein pool administrators and managers are encouraged to “timely and fully disclose” information like “claim comparison tables” for patents in the pool and the results of essentiality determinations.

The Chinese government itself may even launch a patent pool in its own right: On April 23, CNIPA Commissioner Shen Changyu stated in an interview with China Daily that the agency is “planning to establish a patent pool for AI large models to support the sustainable growth of enterprises”.

US Policy Update: Lawmakers Reintroduce PERA, PREVAIL; TPLF Tax Bill Is Sidelined; Squires Nomination Moves Forward; USPTO Arrives at a Critical Juncture

In May, Senators Thom Tillis (R-NC) and Chris Coons (D-DE) (with additional lawmakers) reintroduced the Promoting and Respecting Economically Vital American Innovation Leadership Act (PREVAIL Act), aimed at reforming AIA reviews; and the Patent Eligibility Restoration Act (PERA), which if passed, would widen the scope of what may be patented. RPX members can access in-depth reporting on these bills here.

Also in May, Senator Tillis introduced a bill to impose significant taxes on qualified litigation proceeds received by third-party funders. The litigation finance industry waged an intense lobbying effort ahead of the Senate’s vote on the One Big Beautiful Bill Act, but ultimately, it was the budget reconciliation process, and more specifically, the Byrd rule, that sidelined the Tackling Predatory Litigation Funding Act.

As the Senate debated the reconciliation bill, Senator Tillis emerged as one of three Senate Republicans who publicly opposed the major tax and spending legislation. According to The Wall Street Journal, Senator Tillis had reportedly “already made up his mind to leave the Senate”, but a heated exchange with President Trump over the bill appears to have moved up his timeline for retirement. Senator Tillis announced on June 29 that he will not seek re-election in 2026.

With Senator Tillis’s retirement, the PERA and the PREVAIL Act will lose their primary co-sponsor.

Also during Q2, the White House’s pick for the next USPTO director, John A. Squires, was voted out of the Senate Judiciary Committee via a roll call vote of 20-2, with only Senators Cory Booker (D-NJ) and Sheldon Whitehouse (D-RI) voting nay. Full details of that vote can be viewed here, with RPX coverage of Squires’s Senate confirmation hearing, held in May, available here.

During his Senate confirmation hearing, Squires was questioned by Senator Ted Cruz (R-TX) on the PTAB—namely, whether the system is “functioning as Congress intended”.

In response, Squires cited data indicating that the PTAB invalidates a high number of patents, with IPRs having a “68% defect rate”.

“If you look at the data, the concerns are in plain sight”, said Squires. “If the American patent system was a factory, 68% of the products we put out are found defective in a later proceeding”.

The solution, according to Squires is to ensure that patents are “born strong”.

The onus to grant what Squires refers to as “born-strong” patents is on the USPTO, but during Q2, the Government Accountability Office (GAO) released a report calling the USPTO out for a purported longstanding emphasis on quantity of output (i.e., the number of patent applications examined) over the “quality of such review”.

The GAO’s report was released amid continued calls to address the USPTO’s all-time high backlog of pending patent applications (which per the USPTO’s Patent Dashboard, hovered around 814,000 as of the publication date of this blog post)—and as the agency continued to grapple with staff attrition.

RPX members can access a closer look at these and other Q2 IP policy developments here.

Patent Market Update: New Funded NPE Litigation and Notable Patent Transactions

Through frequent and systematic review of public documents, including court, corporate, and regulatory filings, RPX subject matter experts have identified hundreds of relationships between patent holders and specific third-party litigation funders.

During the second quarter of 2025, RPX flagged multiple new patent campaigns initiated by plaintiffs tied, by public records, to litigation funders, including litigation finance firms and hedge funds. RPX members can access a round-up of that activity here.

– Notable Patent Transactions Made Public in Q2

RPX also conducts continuous review of USPTO assignment records to identify transactions that may portend new monetization campaigns or future patent litigation. Notable assignees that received patents in Q2 include Adeia Inc. (see here); multiple NPEs under the Equitable IP Corporation umbrella (here); Magma Scientific, LLC (here); an Atlantic IP Services Limited plaintiff (here); and an entity formed by a New York City-based hedge fund (see here).

Additional RPX Patent Market Intelligence

Visit RPX Empower for further analysis and up-to-date information on patent litigation and market trends.

* This analysis was updated on January 12, 2026 to account for technical issues with the underlying logic.