E-Commerce and Software Space Hit by Familiar Figures in Q1

June 11, 2025

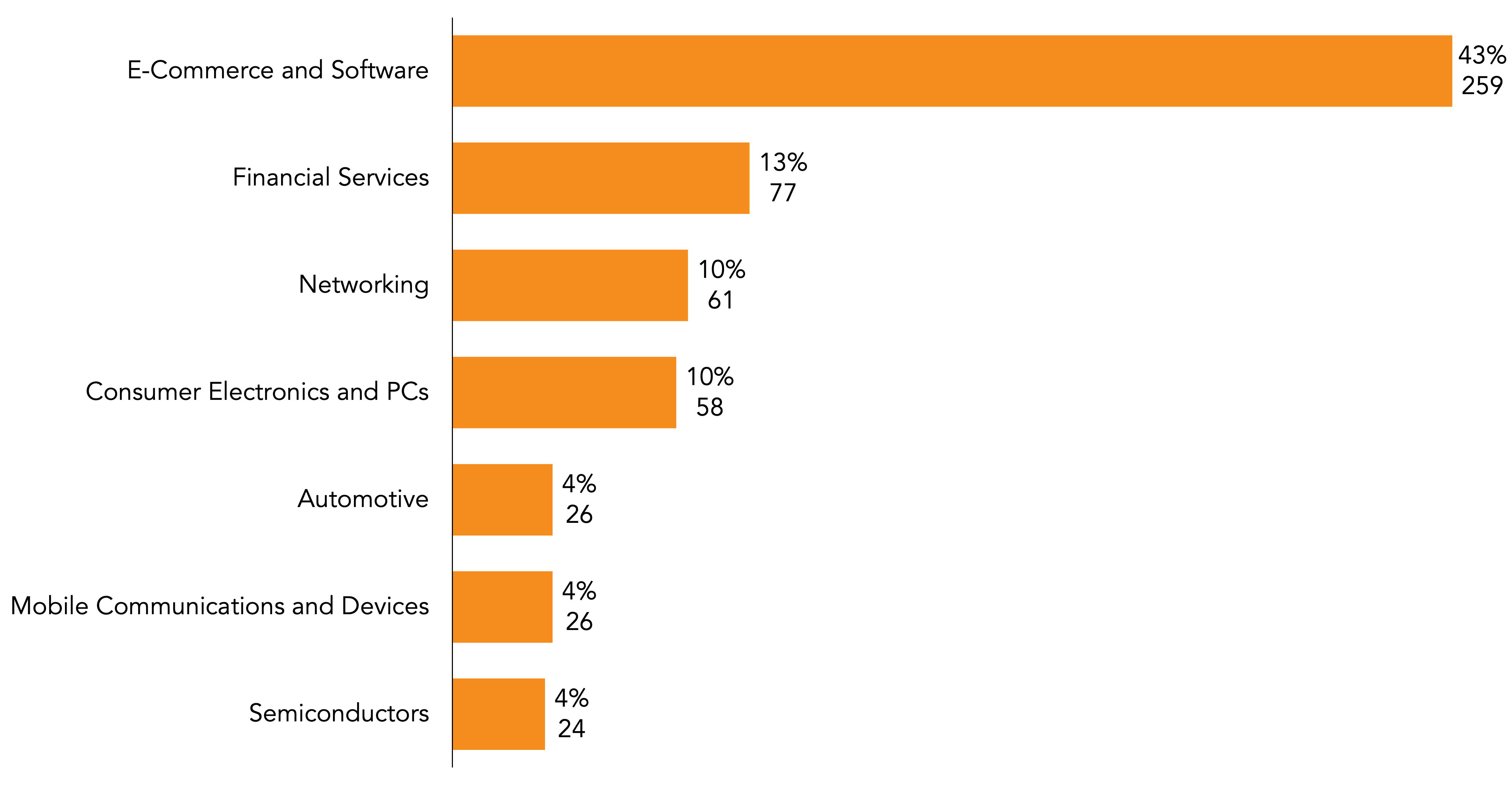

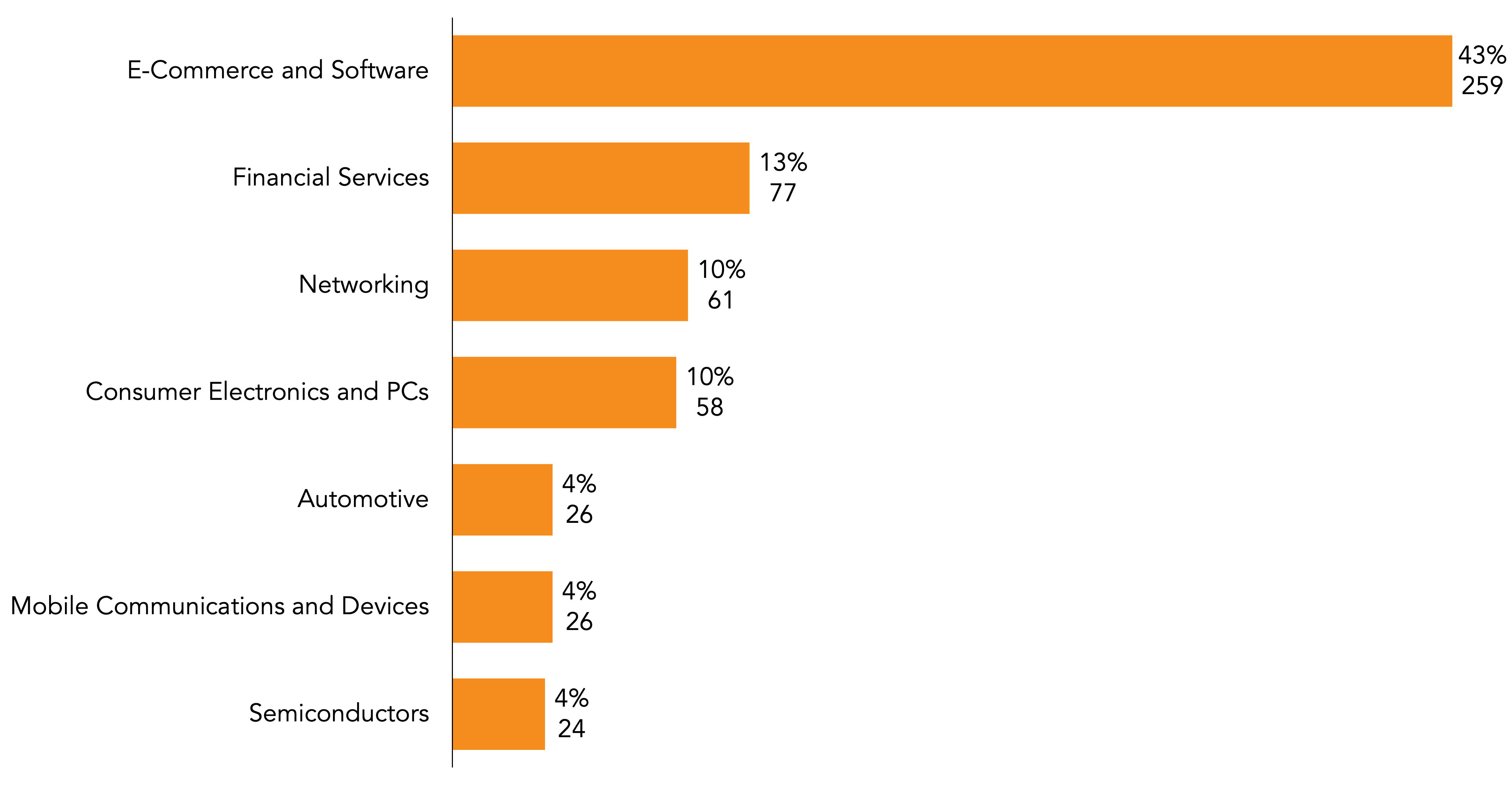

The top market sector for NPE litigation in Q1 2025 was E-Commerce and Software, accounting for 43% of the defendants added to patent litigation campaigns during the quarter. Financial Services saw the second highest amount of NPE litigation in Q1, followed by Networking, Consumer Electronics and PCs, and Automotive.

E-Commerce and Software also saw the greatest increase in the number of defendants added compared to the same quarter last year—going up by 93% (from 134 defendants to 259 defendants). Also seeing a significant percentage increase, albeit with smaller relative numbers, were Automotive (up by 160%, increasing from 10 to 26 defendants added), Financial Services (up by 88%, from 41 to 77 defendants added), and Semiconductors (up by 85%, from 13 to 24 defendants added).

Among the NPEs that filed the most E-Commerce and Software litigation this past quarter were a variety of plaintiffs associated with notable individuals active in the patent assertion space. One patent monetization professional who appears to be linked to a growing number of NPE plaintiffs was particularly prolific in this space in Q1, hitting E-Commerce and Software products and services through 11 distinct plaintiffs that filed litigation throughout the quarter. Those include nine NPEs formed in New Mexico (listed in reverse chronological order by case filing date): first-time plaintiffs SmartOrder LLC, targeting mobile ordering, pickup, and curbside to-go services (covered here); Fintegrity LLC, products with functionality for authorizing financial transactions and preventing fraud (here); Monitor Systems LLC, traffic monitoring and enforcement systems (here); TicketMatrix LLC, NFL season ticket systems (here); PanoVision LLC, websites and software with tools for customizing room designs (here); BillSure LLC, products with features for monitoring users’ spending data and identifying anomalies (here and here); and Quantion LLC, Wi-Fi systems with features for displaying advertisements to users (here); plus existing litigants Muvox LLC, hitting content recommendation systems that allegedly utilize AI (here); and FrameTech LLC, enterprise products with functionality related to remote operating system upgrades (here). Still more NPEs linked to that same individual, these ones incorporated in Delaware, also added complaints to existing campaigns: Hyperquery LLC, focusing on app stores/marketplaces and game subscription services (covered here); and Secure Matrix LLC, websites with secure authentication (here).

Also hitting this sector was Rothschild Patent Imaging LLC (RPI), a plaintiff tied to a former inventor who in recent years has shifted to the assertion of patents acquired from others. In mid-March, RPI added two new complaints to its ongoing image sharing campaign targeting disparate accused products: cameras with support for filtering images and then transmitting alerts or data to a paired mobile app on the one hand, and an online dating platform with features for showing matches based on a distance filter.

In addition, early February saw Dialect, LLC add a new case targeting virtual assistants and supporting products that utilize natural language processing and voice recognition to the campaign that it launched in February 2023. Dialect, which has procured litigation funding (according to a 2022 filing), is connected to yet another well-known figure in patent monetization associated with established NPE plaintiffs with somewhat rocky litigation histories—including Oyster Optics, LLC and Document Security Systems, Inc. Days later, WinView IP Holdings, LLC, an entity formed by the chairman of sports betting company WinView, restarted a campaign targeting online betting and gaming platforms previously waged by the latter company—this time with funding in hand.

Multiple established monetization firms also hit the E-Commerce and Software space this past quarter—including Empire IP LLC, which, through plaintiff AR Design Innovations, LLC, added a new complaint targeting e-commerce apps with certain augmented reality (AR) features to a campaign started in 2020. Others joining the fray were three NPEs associated with Dynamic IP Deals, LLC (d/b/a DynaIP) and affiliated entity Pueblo Nuevo LLC: Random Chat LLC, which in and mid-January and late February collectively added several more retailers to a campaign begun in June 2024, targeting the defendants’ websites’ respective customer support chat features; WirelessWERX IP LLC, which throughout January and February filed a wave of complaints against products with geofencing features (see here, here, and here) to the campaign that it began in late 2022; and AK Meeting IP LLC, which focused on web conferencing products with remote screen control features in a complaint added to the campaign that it also kicked off in 2022. Georgia-based monetization firm IPInvestments Group LLC, through associated plaintiff DataCloud Technologies, LLC, also filed another round of cases targeting mobile apps, website infrastructure, and/or firewalls utilizing certain virtualization technology.

See RPX’s first-quarter review for more on the key trends shaping patent litigation so far in 2025.